Frequently Asked Questions

-

What is AML compliance?

Anti-money laundering (AML) compliance refers to the practices (a risk based approach to customer due diligence) applied by a business

to satisfy regulatory requirements put in place and enforced by national governments to mitigate the use of money to finance terrorism, as

well as prevent money made from criminal activity entering the economy.

Sanction

A sanction refers to the seizure, freezing of assets or inability to participate in economic development imposed on a specific person, a business entity or an entire country by the United Nations Security Council. Specific nation-states may impose economic sanctions against other states to gain an advantage-these are outside the U.N’s purview.

- Global watchlists

- Regulatory bodies

- Law Enforcement agencies

PEP

While doing business with a Politically Exposed Person isn’t risky in of itself, understanding the level of exposure and influence a PEP has on altering or influencing a financial transaction (including susceptibility to bribery) allows your business to make informed decisions about the integrity with which a transaction is being initiated without exposing your business to corruption.

- Structured profiles

- Syndicated database

- Real-time updates

- RCAs enriched insight

Adverse Media

Adverse Media relates to information published incredible news publications whether as part of traditional (newspapers) or new (blogs, newsletters...etc.) media on politically exposed persons, human trafficking & war crime trials by the International Criminal Court, as well as daily news on financial crimes and criminal behavior.

- Credible news sources

- Enriched live profiles

-

How does ReThink DIDN meet the Customer Due Diligence requirement of a risk-based approach to compliance?

A risk-based approach to compliance acknowledges that there are should be increasing checks based on the risk assessment of a potential customer. A risk-based approach refers to the process of applying reasonable measures to know your customer (KYC) based on the risk assessment level. For example, politically exposed persons (PEPs), will likely require enhanced due diligence and additional checks. DIDN enables you to use our Identity Auditor to easily turn on features such as ongoing monitoring, additional checks for adverse media, or database checks based on the customer.

KYC

You can perform an identity verification at user onboarding to identify who your new customer is and use biometric authentication for future logins and transactions to quickly verify their identity again. We’re constantly expanding our database and now already support over 6000 government issued documents from all over the world.

AML

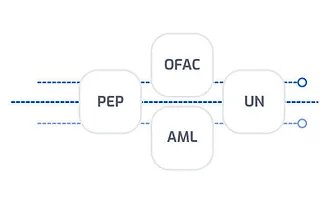

Our AML compliance program covers regulatons in over 190 countries. These include: the 6th Anti-Money Laundering Directive (6AMLD) in the European Union, the Patriot Act of 2001 in the United States and across supervisory authorities such as the SEC, World Bank, Interpol, U.N and OFAC’s published registers.

-

Why do companies need Customer Due Diligence?

Customer due diligence began in the financial sector to reduce money laundering and fraud. Companies initially introduced customer due diligence based on regulations, such as the 6th AMLD in the EU and the Patriot Act in the US. However, performing customer due diligence today helps any business know who their customers are to reduce the risk of fraud and serving bad actors.

Industries

AML compliance began in the financial sector and has since expanded to other industries depending on the market. For example, this can include legal, accounting and real estate firms. Increasingly crypto and digital asset service providers are required to perform KYC checks to meet AML compliance requirements.

Benefits

Heavy fines have been applied to financial institutions that did not take measures to reasonably prevent criminal behavior before it happens. CDD provides peace of mind that you can reasonably expect to be doing business with someone trustworthy, or provide context for determining and mitigating risks where they arise without losing capital, assets or compromising the integrity of your business.

- Fraud reduction

- Increase platform trust

- Compliance with regulations

- Avoidance of heavy fines

- Increased platform security

-

What regulations are covered by the DIDN AML compliance program?

The DIDN AML compliance program covers regulations in over 190 countries. These include the EU's 6th Anti-Money Laundering Directive (6AMLD) and Patriot Act of 2001 in the United States, amongst others. Sanctions enacted by the United Nations Security Council are only valid when entered into law as required of all G-20 countries. Official, published registers of these enactments by country & the U.N Security Council’s consolidated list are represented.

-

Which countries do you cover?

We cover documents from over 190 countries. To date, our database features more than 6,000 documents including passports, drivers’ licenses, and national IDs.